What makes FamPay secure? 🔐

A card app? For teens?!

We don't blame you (or your parents) for thinking twice about how much trust they can put in FamPay. 🤔 We all know just how important security is, especially when it comes to trusting someone, or something with your money. That's why we've written this blog.

Allow us to explain exactly why and how FamPay is the most safe and secure neo-bank for teens!

We are partnered with an RBI regulated entity PPI issuer 🏦

By partnering with a bank, we are allowing the best of the best payments and financial services to be provided through our app and prepaid card. As the bank takes care of important backend processes, we work on allowing our users to have the best experience with us.

FamPay doesn't require linking of bank account 🚫🔗

The FamPay account is reloadable and requires you to load money into your account before you can spend it. It is not linked with any bank account, meaning until you have loaded money into the FamPay app, you will not be able to spend it. The FamCard also works in the same way. This way, you can always be assured that extra money can never be deducted from your bank account, and that you have the liberty to set spending limits for yourself.

There are no hidden charges, and no minimum balance 🤑

With FamPay, you can have the assurance that your money won't magically disappear in the form of hidden charges! There is also no minimum balance that you are required to maintain in your FamPay account, which makes it all the more convenient.

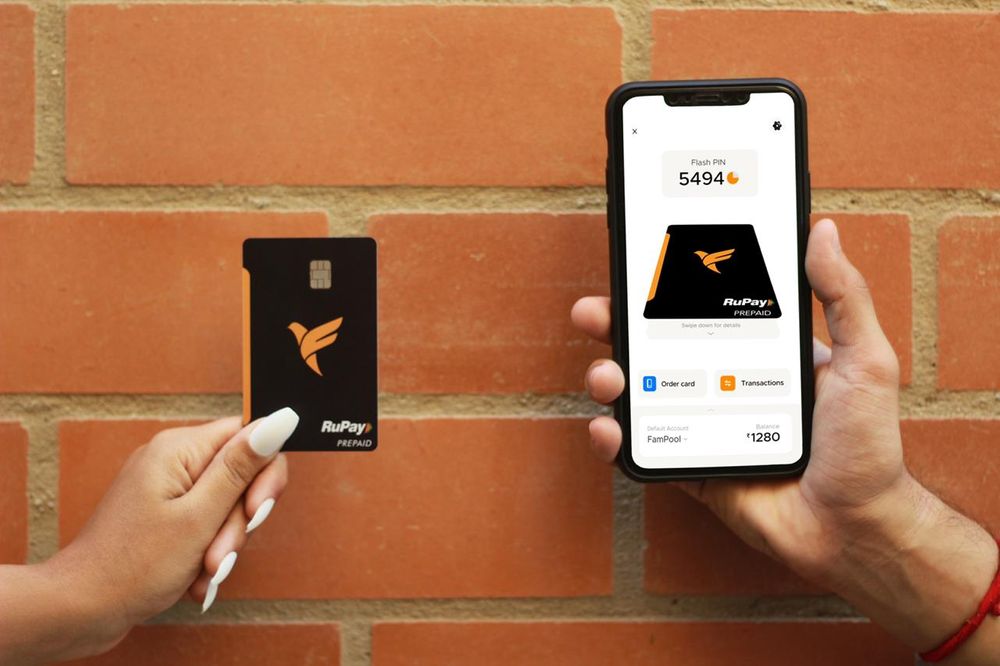

The FamCard is numberless 💳

The FamCard has no numbers on the physical card, which makes it very secure. The card number and other details (expiry date, CVV) are stored securely within the FamPay app instead of being printed on the physical card. There’s no fear of card information getting misused in case it gets stolen or lost and the card can be paused, blocked and managed at your fingertips on the app. Additionally, the card details within the app can be accessed only with device lock such as fingerprint, face ID, pattern lock or PIN.

You can click here to know more about our numberless FamCard!

Built by IIT grads, believed by the best 👨💻👨💻

With an itch to inculcate the value of money in the youth of India, and lead them towards financial literacy, Sambhav Jain and Kush Taneja founded FamPay immediately after graduating from IIT Roorkee. The founding team started with 6 IITians, and has now encompassed over 50 members from across the country. FamPay is also backed and trusted by Sequoia, Y Combinator, and several noteworthy investors such as Kunal Shah (Founder of Cred), Kevin Lin (Co-founder of Twitch), Neeraj Arora (Ex-WhatsApp), and more!

Read more about our founders' journey here.

Our team is constantly working on handling errors 🦹♀

The reconciliation team works tirelessly to take care of any transactions that get stuck. We are aware of how frustrating such a situation can be, which is why we've got our best minds solving such issues. In case of any payment issues, our team takes care of the payment manually, so you can be assured that your money is still safe. This includes refunding any failed transactions within 5-7 working days.

Click here to know more about payment issues and how our team works on fixing them.

Our Customer Support is here to help 🦸♀️

If you ever face any issues, do not worry as our customer support is always available and ready to assist you.

For basic queries, you can refer to the FAQs section found in the app, as well as on our website. In case you are stuck and your query is still not solved, you can reach out to us on email (support@fampay.in), or talk to us through chat support available on the app.

And that's it! Now you can take comfort in the fact that your money and information will always be safe with FamPay. ❤️ Go ahead and share this piece with your friends and family to help ease any anxiety they may have in relation to making payments on our app. You'd be doing them a favour. 🤗